After-tax incomes fell sharply at the top of the distribution in 2008 and 2009 but have since partially recovered. 21 and 22 of the Income Tax Act 1947.

Pin By The Project Artist On Understanding Entrepreneurship Tax Free Bonds Corporate Bonds Tax Brackets

Although the income tax act of 1913 instituted only mild progressivity and raised a relatively small amount it was still a monumental development.

. Stratton The Roots of the Income Tax National Review April 17 1995. 00101 Any corporation or any other entity taxed as a corporation under the Internal Revenue Code whether foreign domestic or domesticated shall be subject to the Nebraska income tax. PART I Income Tax DIVISION A Liability for Tax.

Act to be construed as one with Income Tax Act 1947. Taxable income 2 The taxable income of a taxpayer for a taxation year is the taxpayers income for. 1 Australias income tax treaties are given the force of law by the International Tax Agreements Act 1953The Agreement between the Australian Commerce and Industry Office and the Taipei Economic and Cultural Office concerning the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income is a document of less than treaty status.

In this Act unless the context otherwise requires 31 advance tax means the advance tax payable in accordance with the. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Any refund of state or local income tax which was included in federal adjusted gross income shall be subtracted.

Tax payable by persons resident in Canada 2 1 An income tax shall be paid as required by this Act on the taxable income for each taxation year of every person resident in Canada at any time in the year. 381-384 1959 or is not a. Tax payable by persons resident in Canada 2 1 An income tax shall be paid as required by this Act on the taxable income for each taxation year of every person resident in Canada at any time in the year.

Roberts Paul C and Lawrence M. The amount donated towards charity attracts deduction under section 80G of the Income Tax Act 1961. 3 Save as otherwise provided in this Act it shall come into force on the 1st day of April 1962.

PART I Income Tax DIVISION A Liability for Tax. 21 This Act may be called the Income-tax Act 1961. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. 2 Act 1967 wef. Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax.

1961 Income Tax Department All Acts Income-tax Act 1961. A Labuan entity can make an irrevocable election to be taxed under the Income Tax Act 1967 in respect of. Avoidance of income-tax by transactions resulting in transfer of income to non-residents.

The main features of tax benefit with. Section 80G has been in the law book since financial year 1967-68 and it seems its here to stay. The up-and-down pattern in 2012-13 may reflect in part decisions by wealthy taxpayers to sell appreciated assets in 2012 in order to pay taxes on those capital gains before income tax rates increased in 2013.

Omitted vide Finance No. INCOME TAX ACT 1967 1. This Practice Note is issued to explain the meaning of factory stated in paragraph 9 Schedule 7A of the Income Tax Act 1967 ITA.

REG-24-001 Entities Subject to the Corporation Income Tax. 2 It extends to the whole of. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1.

2 Act 1967 20 of 1967 Taxation Laws Amendment Act 1967 27 of 1967 Finance Act 1968 19 of 1968 Punjab Reorganisation and Delhi High Court Adaptation of Laws on Union Subjects Order 1968. 2 It extends to the whole of India. Several deductions have been swept away but the tax sop for donations appears to have survived the axe.

Royalties fees or contributions certificate means a certificate issued under section 37. This Act is the Economic Expansion Incentives Relief from Income Tax Act 1967. 00205B Refund of State and Local Income Tax.

Factory means portion of the floor areas of a building or an extension of a building used for the purposes of a qualifying project to place or install plant or. 1 This Act may be cited as the Income Tax Act 1967. Guidelines under clause 23FE of section 10 of the Income-tax Act 1961 - reg Further the Finance Act also relaxed the condition requiring an AIF to have investment in eligible Circular No.

This Act may be called The Income-tax Act 1961. Taxable income 2 The taxable income of a taxpayer for a taxation year is the taxpayers income for. Provided such corporate entity is not exempt under the provisions of Public Law 86-272 15 USCA.

Extension of time line for electronic filing of Form NO10AB for seeking registration or approval under Section 1023C 12A or 80G of the Income. Any person subject to tax under the Nebraska Revenue Act of 1967 as amended or any person required to file an information return for the taxable year shall keep such permanent.

Best Payroll And Tax Services In Switzerland

Section 161 To 167 Of Sindh Land Revenue Act 1967 In Urdu Hindi English Appeal And Revision Youtube Sindh Acting Revision

Chapter 5 Non Business Income Students

Pdf Income Tax Law Simplification And Tax Compliance A Case Of Medium Taxpayers In Zanzibar

Hhqfacts Perquisites From Employment Case Facts By Hhq Law Firm In Kl Malaysia

Rosario V Dionisio 1894 1967 Was A Member Of The Colorado Crime Family Rosario Was The Former Owner Of The Colorado Cheese Co In Crime Family Mafia Mobster

Pdf Income Tax Law Simplification And Tax Compliance A Case Of Medium Taxpayers In Zanzibar

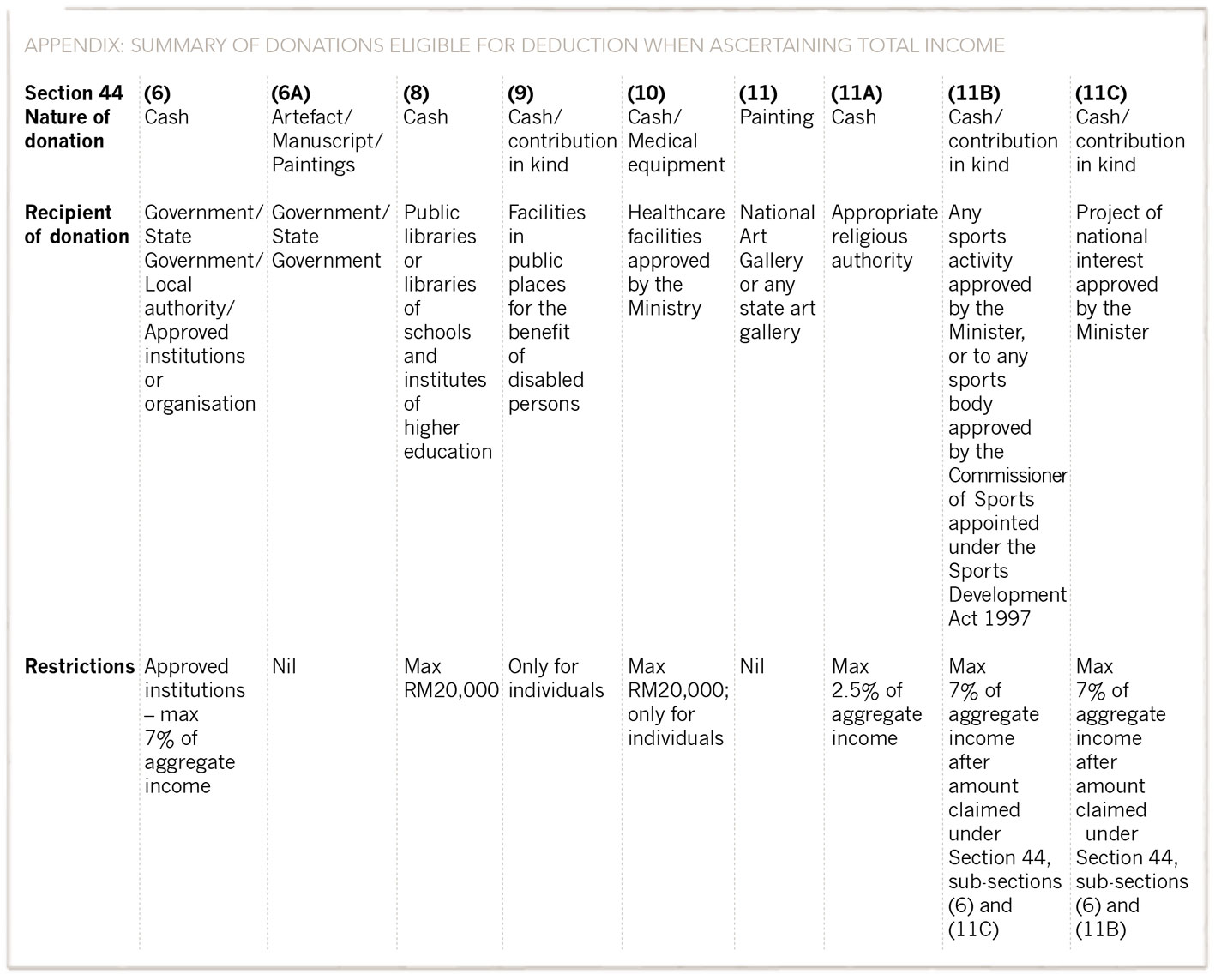

Aggregate To Total Income Acca Global

Top Quality Payroll And Tax Services In Belgium Tax Services Payroll Financial

General Deductions Of Expenditure Under Section 37 1

Ilmpatwar Income Tax Finance Revenue